Recent Updates

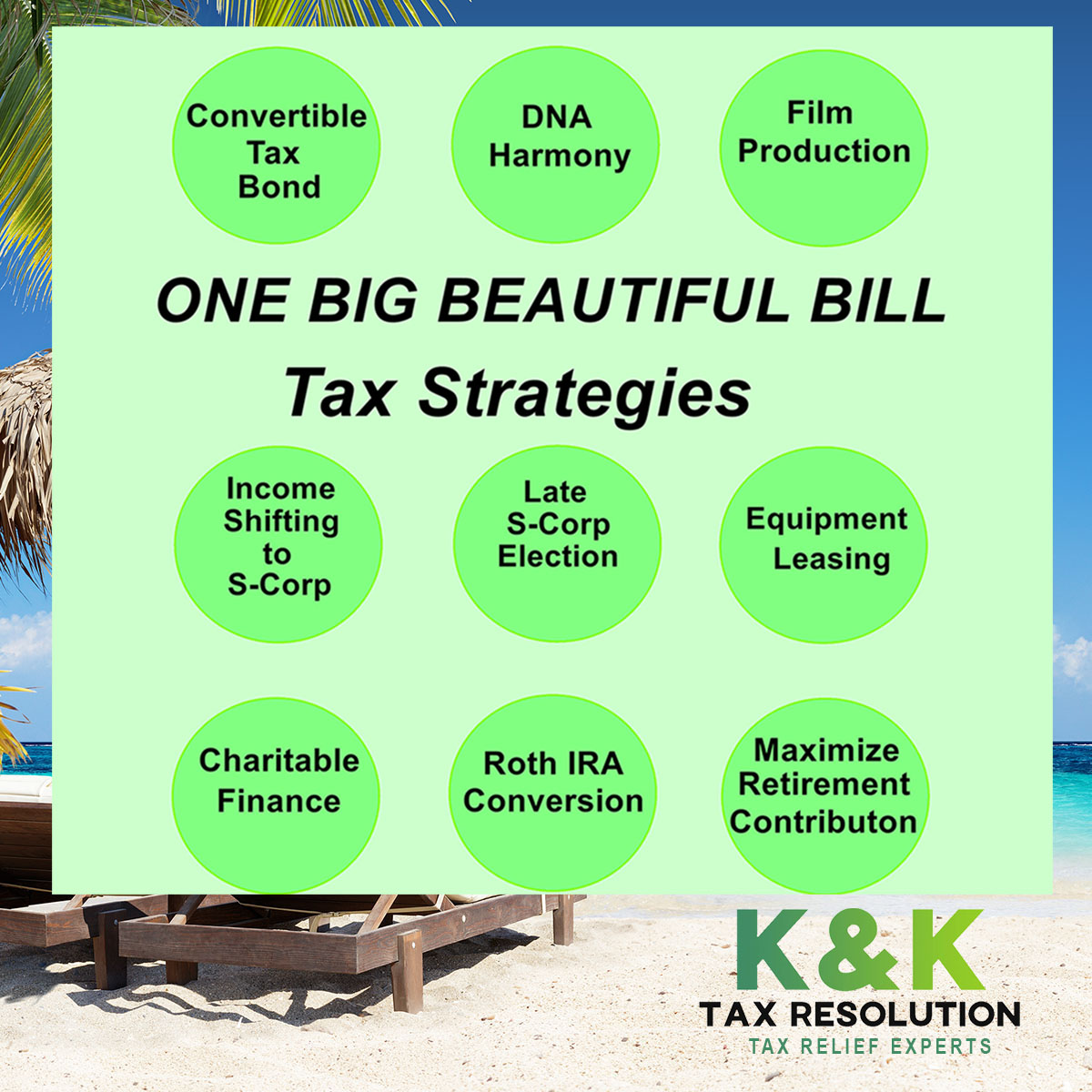

One Big Beautiful Bill Act (OBBBA)

We're diving deeper into proactive tax planning for 2025 and beyond!

With President Trump signing the “One Big Beautiful Bill Act” (OBBBA) on July 4, 2025, we're preparing to break down what it means for you.

Big change happens one step at a time. Each adjustment in our One Big Beautiful Bill is a small win on the road to a brighter tomorrow.

Don’t wait until the last minute—start planning today to maximize your savings and minimize what you owe. With the right strategies in place, you can take advantage of deductions, credits, and proactive moves before the year ends.

Act now and set yourself up for a stress-free tax season. Your future self will thank you!

Tax Preparation, Tax Planning & Tax Resolution – Know the Difference?

✅ Tax Preparation = "Doing your taxes" - Filing your taxes accurately & on time with help from a CPA, Tax Preparer or tax software to ensure compliance with tax laws by gathering financial documents, calculating tax liabilities, and filing tax returns with the IRS or state tax authorities.

✅ Tax Planning = “Strategizing for the future” - a proactive approach to managing your taxes throughout the year with an Advance Tax Professional that can help you focus on strategies to minimize your tax liability over the long term.

✅ Tax Resolution = “Fixing past tax problems” - addresses tax issues that have already arisen, working with a Certified Tax Representation Consultant (CTRC) to resolve tax problems and manage communication with the IRS.